SUMMARY

When it comes to financial planning, there’s a lot to consider. Here are some tax implications you should keep in mind when creating and revising your financial plan.

Your Financial Life

7 minute read time

When it comes to financial planning, there’s a lot to consider. Here are some tax implications you should keep in mind when creating and revising your financial plan.

In the words of Benjamin Franklin’s simple, yet profound, proverb, “Nothing can be said for certain, except death and taxes.” Said more candidly – taxes are here to stay. But how does this impact financial planning? Well, one would be remiss to avoid considering the tax implications of an individual's personal financial plan – both now and in the future.

When assessing your financial plan, it’s important to review the distinctions between different investment and savings vehicles to understand how and when earnings are subject to income tax. Learn how these tax implications align with your short- and long-term financial goals, considering various factors like stage of life, career plans, retirement horizon and the legacy you want to build. Anisa Dunn, SVP Wealth Sr. Fiduciary Manager, provides insight so you can be equipped to evaluate the best options for your personal situation.

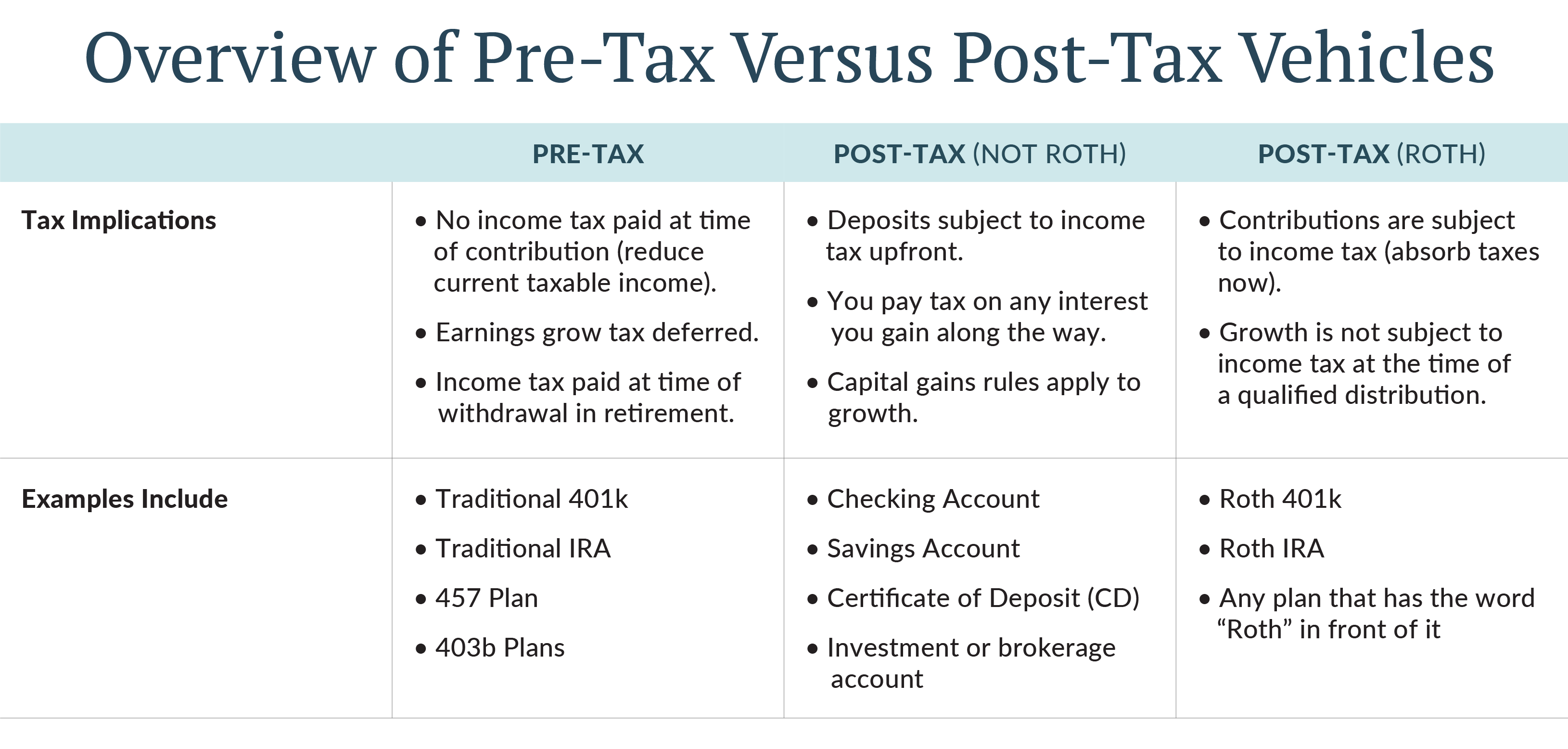

“Pre-tax” and “post-tax” are terms commonly heard in relation to retirement and financial planning. Both can be used as a part of an effective strategy to help you achieve your financial goals. Here’s the difference between the two:

Pre-tax accounts

Pre-tax accounts Pre-tax retirement accounts provide a distinct opportunity for growth because earnings grow tax deferred. While money can be contributed income tax-free, future withdrawals made in retirement will be subject to standard income tax, based on the individual’s tax bracket at the time of withdrawal. Common examples of pre-tax investment accounts include Traditional 401ks and Traditional Retirement Account (IRAs):

Traditional 401ks are employer-sponsored retirement savings accounts. They can be great wealth-building tools, especially if the employer offers a matching contribution. Pre‐tax contributions and earnings in the Traditional 401(k) are tax-deferred and taxed at distribution. The contribution limit for 2024 is $23,000 and the maximum catch-up contribution is $7,500 for individuals aged 50 or older.

A Traditional Individual Retirement Account (IRA) isn't employer-sponsored and can be opened by anyone who receives taxable compensation during the year. If you, or your spouse (if you're married) contribute to a retirement plan at work, then there are income limits that might restrict your ability to deduct your IRA contribution. Like Traditional 401ks, pre-tax contributions and earnings grow tax deferred, and earnings are taxed at the time of distribution. The contribution limit for 2024 is $7,000, and the maximum catch-up contribution is $1,000 for individuals aged 50 and older.

Post-tax accounts are subject to income tax upfront. Earnings are deposited into an account where it can accrue interest or growth. You pay taxes on any interest you gain along the way. Common examples of post-tax accounts include: checking accounts, savings accounts, Certificates of Deposit (CDs) and brokerage or investment accounts.

Post-tax Roth accounts, on the other hand, provide a unique distinction. While contributions are funded with post-tax dollars, earnings aren't subject to income tax at the time of a qualified distribution. Examples of post-tax Roth accounts include:

Roth 401ks are subject to employer availability. Contributions and catch-up limits are the same as a Traditional 401k. While contributions are subject to income tax upfront, qualified distributions are completely income-tax-free.

If an individual has earned income below a certain threshold set by the IRS, a Roth IRA may be a good option. Like Roth 401ks, contributions are made after tax and distributions aren't subject to income tax. Roth IRAs may provide more flexibility and control, as there are no required minimum distributions (RMDs) in retirement.

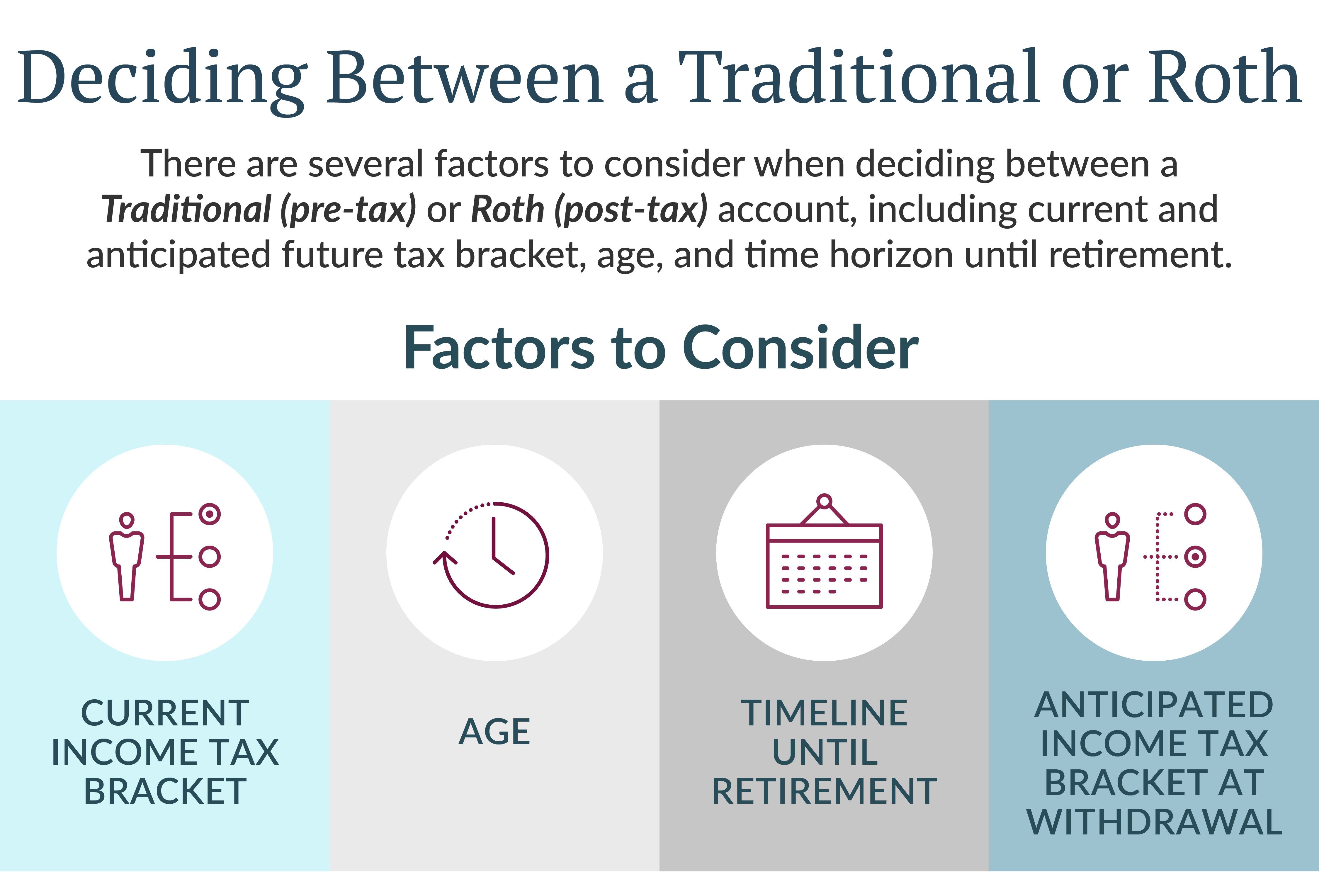

It's hard to anticipate what the tax brackets will be when you retire. But as Benjamin Franklin predicted, they aren't likely to go away. Here’s how to choose the right one for you:

Pre-tax accounts are often an attractive option for individuals who are currently high-income earners in a high tax bracket. For individuals who expect lower income in retirement, a pre-tax option may be suitable.

Additionally, contributing to a pre-tax account may be appropriate for someone who desires to reduce their current income to avoid bumping up to a higher tax bracket, essentially lowering their tax liability for the year.

On the other hand, someone who expects to have a higher income rate in retirement than in their working years may find a post-tax Roth vehicle advantageous. For example, a Roth account may appeal to younger individuals with a long timeline until retirement. Young professionals and those early in their careers may be in a lower income tax bracket. By paying taxes now, these individuals can avoid paying a higher income tax when withdrawing the funds in retirement. Additionally, those who desire to reduce taxable income during retirement may consider contributing to a Roth account.

Roth accounts can also be used strategically to build a legacy. Individuals who have no intention of using their accumulated assets during their lifetime may look to pass down the money to their heirs. With a Roth account, beneficiaries can inherit the funds without being required to pay income tax on the distributions.

Because tax rates and legislation are continually subject to change, it’s important to stay apprised of proposed changes and talk to a financial advisor about adjustments to consider each year. Diversifying assets into Traditional and Roth vehicles is just one way to prepare for potential changes to avoid becoming “stuck” with all your eggs in one basket. Having funds in separate buckets subject to different rules and taxation may provide more flexibility and options as you decide how to spend your money in retirement.

The details outlined here only skim the surface. A trusted financial professional can provide objective, non-biased advice to help you assess your options. We’ll look at the big picture and get to know you, your family and your goals so you have confidence in your financial future. To learn more, connect with one of our advisors today.

Johnson Financial Group and its subsidiaries do not provide tax advice. Please consult your tax advisor with respect to your personal situation. Products and services offered by Johnson Bank, Member FDIC, a Johnson Financial Group Company. Wealth management services are provided through Johnson Bank and Johnson Wealth Inc., Johnson Financial Group companies. Additional information about Johnson Wealth Inc., a registered investment adviser, and its investment adviser representatives is available at https://www.adviserinfo.sec.gov/. NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE