Greetings and Happy New Year! If you are like me, you either already broke your New Year’s resolution or did not make one. I contemplated either “learning a new language” or “writing less about inflation.” Unfortunately, inflation is likely to remain front and center for some time, so it’s just as well I didn’t make a resolution at all.

As I was reminded recently listening to a group of teachers talk shop, every profession has its own language or vocabulary. Before we dig into the most recent CPI report, it might be useful for those that do not speak “Government Statistics” to review the term.

The CPI, or Consumer Price Index, is one measure the Federal Reserve and markets use to monitor changes in prices. It is a rate-of-change index, meaning it measures an “up” or a “down” from one point in time to another. The components of the index are not all equally weighted because they are meant to approximate how we spend our money. That difference in weights can impact the direction of the changes of the CPI dramatically. For example, Used Cars are about 4% of the Index, whereas Housing in its various forms is 42% of the weight.

In addition to the main, or “headline” CPI, there’s also “core CPI,” which takes out impacts of Food and Energy categories. Food and Energy price changes tend to be more volatile in shorter time periods and can therefore skew the numbers from reflecting a longer-term trend.

Most recent CPI data

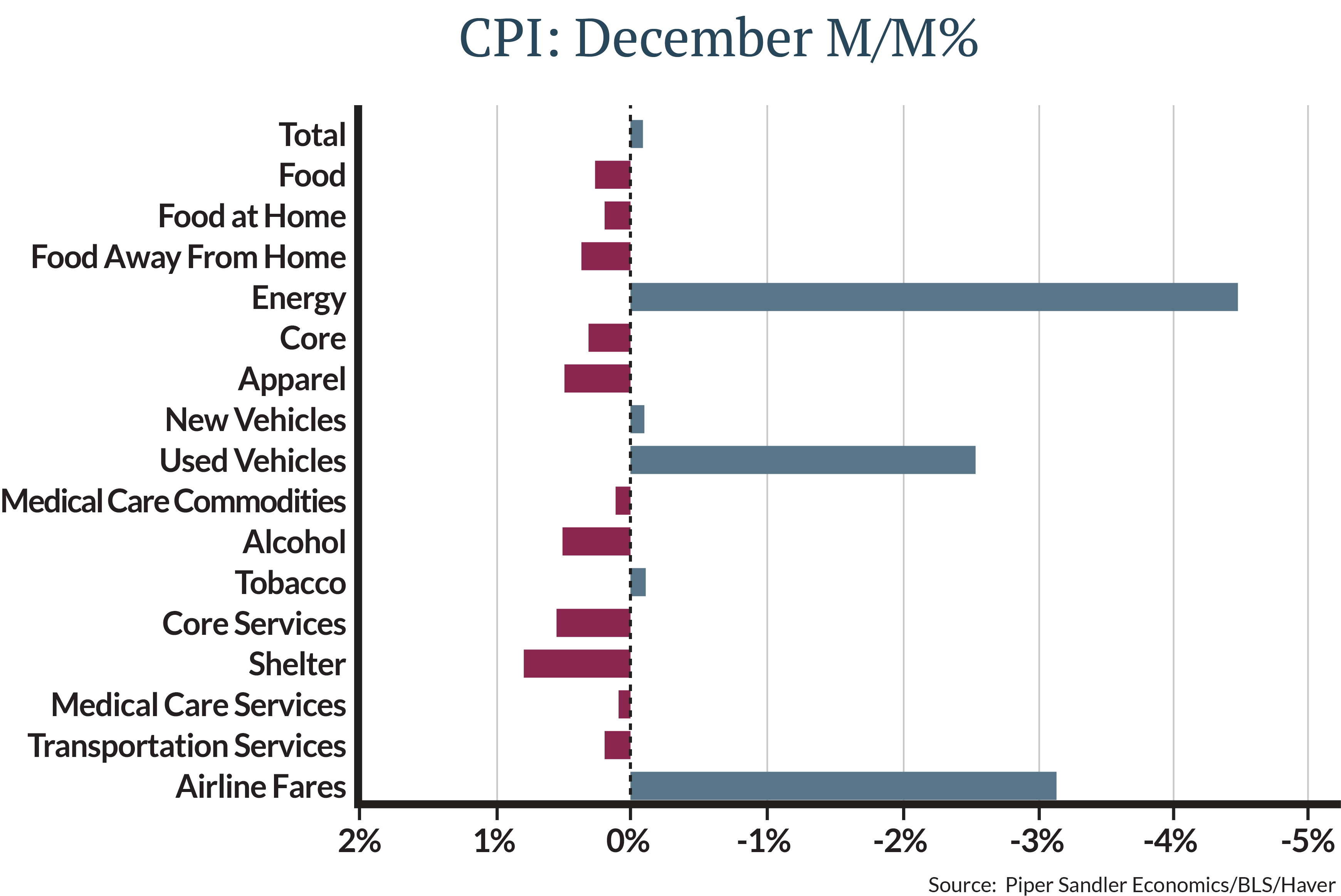

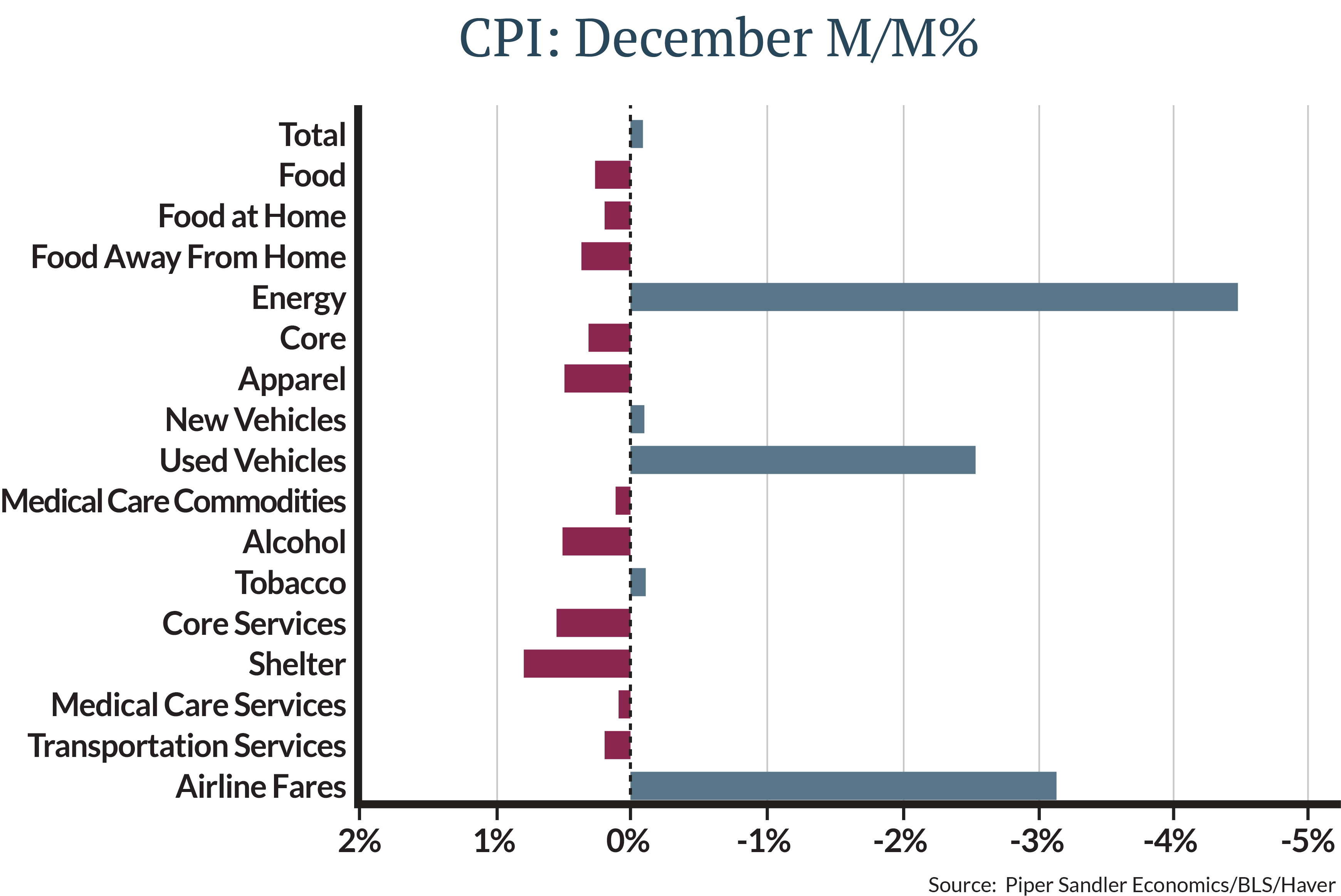

With that as background, let’s look at the most recent CPI report. It came in as the market expected, with the headline value declining a tenth of a percentage point for the month of December and the core slightly stronger by three tenths of a point.

These data points show a slower inflation rate and trend. However, they are still higher than the Federal Reserve is likely going to accept before pausing its pattern of interest-rate increases. Using a three-month trend the annual core CPI would be 4.3%, much better than the 6% not too long ago, but still well above the 2% the Federal Reserve has been targeting.

The good news in the report is that most of the components were down or growing slower than previous periods for the month—except for shelter. As we discussed, shelter is a very large portion of the index. It also tends to lag actual price declines in the markets. If you eliminated shelter from the calculation the reported result for core inflation would have been negative for the month. Housing data suggests that shelter prices will start to trend lower. Indeed, rents, for example, have in fact started to move down in many places.

What’s next?

There are more inflation data points coming but based on these numbers the most likely outcome is the Federal Reserve will continue raising interest rates. During its next meeting in February, we expect the Federal Reserve to increase rates by another quarter percentage point. Furthermore, we don’t expect any change in the rhetoric or communication about future direction.

Investors generally agree with this assessment, so the potential rate hike isn’t likely to cause any additional concern or volatility. Until we get to a point where the market is less obsessed with inflation and the Fed, we will continue to focus portfolio strategy on some of these macro issues.

Hopefully you’re off to a great start on your New Year’s resolution, if any. If your resolution happens to be learning more about Government Statistics, I suggest finding out how your favorite spending component ranks in the CPI by visiting the Bureau of Labor Statistics website (www.bls.gov). To me the value for Coffee seems a little light, compared to what I’m seeing in my own daily life, at just 0.174% of expected spending.