Investment Commentary

Expanding the Advisor Toolkit with Active ETFs

4 minute read time

I would argue that the two most impactful investment innovations over the past half century are index- funds and exchange-traded funds (ETFs). The two are often linked in the public eye, with passively managed, index-tracking ETFs such as SPY and QQQ—which track the S&P 500 Index and Nasdaq-100 Index, respectively—among the largest and most widely traded investment vehicles in existence. But the last few years have seen extraordinary growth in the relatively new market of actively managed ETFs—which don’t track an index—bringing the structural advantages of ETFs to the world of active management and adding new ways for advisors to add value for their clients.

In 1974, John Bogle founded The Vanguard Group and soon after introduced the Vanguard 500 mutual fund to track the S&P 500 Index. Bogle’s idea was that the low costs associated with a passive index-tracking strategy would benefit the average investor in an age when stock trading commissions and brokerage fees were much higher than today. As of the end of last month, Vanguard reported the assets in the Vanguard 500 mutual fund at $1.1 trillion dollars, and last year assets under management in similar passive investment strategies surpassed active strategies for the first time. I’d say he was on to something.

In January 1993, State Street and the American Stock Exchanged launched SPY as the very first exchange-traded fund. Like the Vanguard 500 mutual fund, SPY tracks the performance of the S&P 500 Index. Today, it is the largest, most traded, and most liquid ETF in the world. Other ETFs proliferated through the years, and their market share relative to mutual funds has grown to almost 30% today, up from 13% a decade ago, according to Morningstar [Figure 1]. ETF industry assets rose 13.2% in the fourth quarter of 2023 to $8.1 trillion according to Vanguard.

ETF Market Share Continues to Grow

![Other ETFs proliferated through the years, and their market share relative to mutual funds has grown to almost 30% today, up from 13% a decade ago, according to Morningstar [Figure 1].](/siteassets/images/5_graphs-and-charts/2024/3.22-graph-1.jpg)

Exchange-traded funds introduced structural benefits that propelled their popularity. Unlike traditional mutual funds, ETFs can be bought and sold on an exchange intraday. Their management fees are typically lower than mutual funds as result of lower marketing costs. They are transparent, with most ETFs disclosing their holdings daily rather than mutual funds’ monthly or quarterly reporting. And crucially, they are more tax efficient than mutual funds, allowing investors to largely avoid the capital gains distributions common among mutual funds with high turnover of underlying investments.

But until recently, investing in ETFs usually required choosing a passive, index approach and forgoing the benefits of active management. Not anymore. According to Morningstar data, active ETFs’ growth is exploding. In each calendar year since 2018, they added at least $25 billion, with an organic growth rate of 30%. At the end of October 2023, they claimed $444 billion in assets across over 1,000 different strategies [Figure2].

Active ETFs See Explosive Growth

![At the end of October 2023, they claimed $444 billion in assets across over 1,000 different strategies [Figure2].](/siteassets/images/5_graphs-and-charts/2024/3.22-graph-2.jpg)

Morningstar attributes the explosive growth in active ETFs largely to SEC rule changes in 2019 that gave active managers increased flexibility to access ETFs’ tax efficiency. In addition to new product launches, managers began converting existing mutual funds to ETFs. Of the 1,286 active ETFs listed in October 2023, 65 began as mutual funds, according to Morningstar. 73% of all new ETFs launched last year were active; 10 years ago, active ETFs accounted for only 16% of new launches. It feels like a mini revolution.

Active ETFs in Fixed Income

In our view, the growth of active ETFs is especially interesting in the fixed-income market. According to Morningstar’s most recent Active/Passive Barometer report, 79% of active bond funds that remained in existence over a 15-year period outperformed a passive composite. Picking good managers in fixed income has been rewarding.

We believe the potential for active management to outperform in fixed income is largely a function of deficiencies in the most common fixed income benchmarks employed by passive strategies. For example, the widely followed Bloomberg US Aggregate Bond Index (often called just “The Agg”) represents just 52% of the U.S. public bond market according to JPMorgan. This means investors who stick exclusively to The Agg don’t have access to large parts of the bond market, including significant portions of the securitized market, emerging markets, and below investment grade bonds.

The Agg (and other indexes) also rewards the most indebted borrowers by weighting the index based on how much debt an issuer has outstanding. The explosive growth in U.S. Treasury debt in recent years has bloated its share of the Agg at the expense of agency mortgage-backed securities (MBS) and other securitized assets that we continue to favor [Figure 3]. We believe that active managers with the flexibility to invest across the entire fixed-income universe can better navigate this constantly evolving market.

Bloomberg US Aggregate Bond Index Composition

![Vanguard reports that within the core and core-plus bond categories, four of 2023’s top 10 ETFs in terms of money flowing into them were active strategies [Figure4].](/siteassets/images/5_graphs-and-charts/2024/3.22-graph-3.jpg)

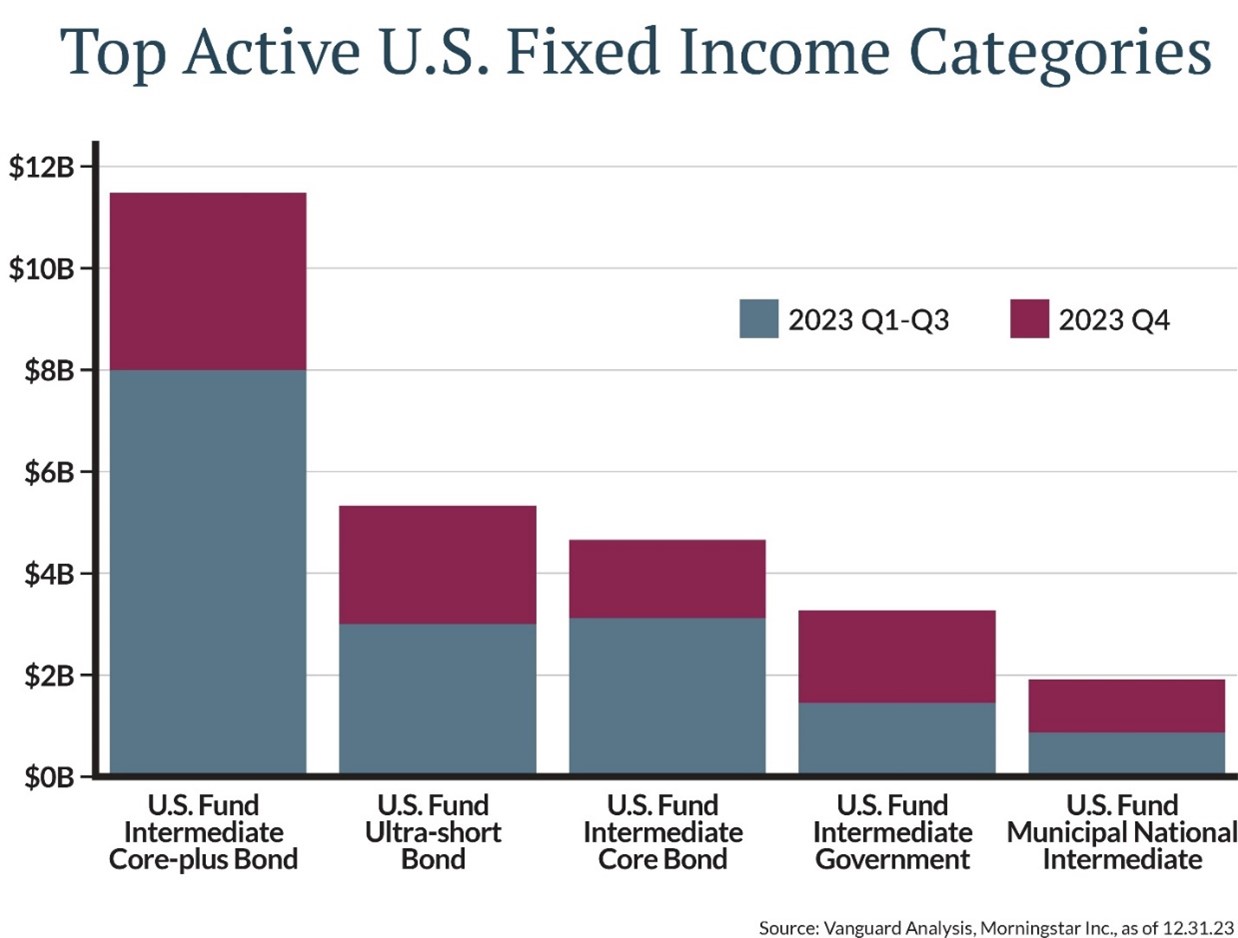

We are not alone in this assessment. Vanguard reports that within the core and core-plus bond categories, four of 2023’s top 10 ETFs in terms of money flowing into them were active strategies [Figure4]. We expect this trend to continue as large asset managers including Vanguard, JPMorgan and BlackRock continue to invest heavily in the space.

Positioning Portfolios with Active ETFs

Money market fund assets reached $6 trillion for the first time in January 2024. As we get closer to an eventual Fed pivot to lower rates and money market yields begin to fall, we believe a sizeable amount of this cash will find its way into the fixed-income market. For example, in our case:

- The first step out of cash is into ultrashort funds, where we like using active ETFs to access attractive yields available in commercial paper, asset-backed securities, and short-term corporate bonds.

- Further out the maturity spectrum, we are using active core-plus bond ETFs to access securitized credit alongside a core allocation to Treasuries and corporate bonds.

Active ETFs will not replace traditional active mutual funds overnight. They have their own set of disadvantages, including the fact that they can’t be closed to new investors. For capacity-constrained categories like US small-capitalization stocks, the mutual fund structure may still be the best wrapper. Similarly, you won’t find private companies in ETFs.

But as their growth and surging popularity have shown, active ETFs are now a permanent and powerful part of the opportunity set for investors and their advisors. If they aren’t in your portfolio today, it’s likely they will be soon.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE