Private Banking

Get the most from your relationship with us. As a private banking client, you’ll have exclusive solutions designed for your unique lifestyle and future plans.

Committed to You and Your Story

Your financial goals are personal. We get to know you, your family, lifestyle, and future goals to help you plan for today and years down the road.

When you work with our team of experienced private banking and wealth management advisors, you’ll have confidence knowing decisions are made with your entire financial life in mind.

Take your next step in confidence, as you -

- Set financial goals for you and your family

- Prepare for changes in your career or business

- Prepare for and transition to retirement

- Protect your assets and your loved ones

Benefits of Private Banking

As your needs shift and grow more complex, you’ll have a team of advisors dedicated to understanding your financial and personal goals.

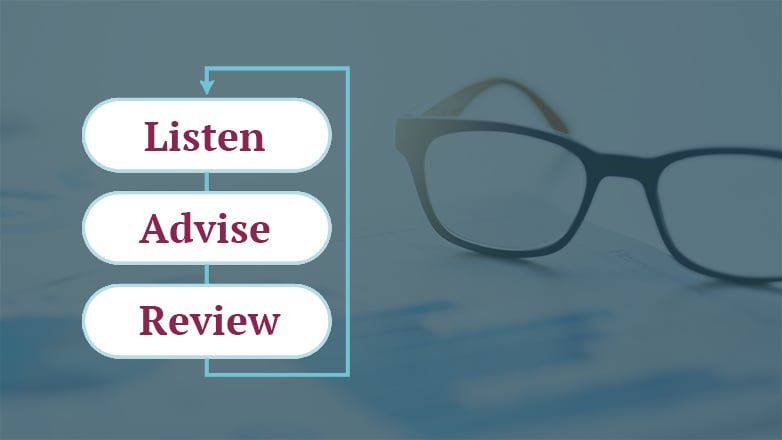

Our Approach

Listen

Committed to understanding your goals.

Advise

Provide advice and solutions for your changing needs.

Review

Ongoing reviews with your team to ensure your plans are on track.

Together, we’ll help you with exclusive solutions.

No matter what financial needs you or your family may have, our team is there for you. From simple to complex, we will work closely with you to provide solid financial advice and innovative solutions to help you achieve your goals.

Cash Management Solutions

Exclusive private banking accounts, with preferred deposit rates, designed to help you manage your money and provide easy access to cash.

Borrowing Solutions

Financing to help strengthen your financial plan with preferred pricing and tailored options designed for you.

What are your financial priorities?

No matter your situation, your financial success requires careful planning and professional guidance. Together, we’ll create a plan as unique as you.

Private Banking Credit Cards

Earn valuable rewards, enjoy luxury travel benefits and experience world-class privileges – all at an exceptional value.